does binance us report to irs

1099s of all types serve the same purpose within the United States all 1099s report non-employment related income. Though these wallets havent had the IRS chasing after them yet if and when they do thats enough information to identify you with.

Binance Us Ceo Steps Down As The Crypto Exchange Faces Rising Regulatory Scrutiny Jackofalltechs Com

How do exchanges report tax information.

. The best way to remain tax compliant with the IRS is to report your crypto taxes accurately. For certain transactions in the United States a 1099-K must be submitted with the Internal Revenue Service. Binance is the largest cryptocurrency exchange founded in 2017 by Changpeng Zhao.

Market use a specific type of 1099 Form to report tax information to the IRS. This goes for ALL gains and lossesregardless if they are material or not. Her Majestys Revenue and Customs HMRC is the tax collection authority of the UK.

No they stopped issuing 1099-K s from 2021 so they dont report to the IRS. Binance owns Trust Wallet and theyre already embroiled in a legal battle with the IRS over operations in the US. BinanceUS The United States said that it would leave the Blockchain Association and establish its own government affairs team in Washington.

Branch seemed a major setback for the industrys main advocacy group. American cryptocurrency users that want to access Binance can instead use Binances partner company BinanceUS. For legal reasons Binance operates in the United States as a separate entity Binance US and does so legally and following the active regulatory stature.

The departure of the worlds largest crypto exchanges US. Does BinanceUS report to the IRS. While Binance US might not be sending out 1099-K forms the IRS is taking a hard stance on crypto tax evasion.

Binance is not a US-based exchange and it does not report anything to the IRS. They have their headquarters in Malta. Apart from that Form 1040 generally known as the US Individual Income Tax Return should be required.

Cryptocurrency exchanges like Coinbase Gemini and others that operate within the US. When a customer earns more than 600 through staking referrals and other income-generating activities BinanceUS issues a Form 1099-MISC and files an identical copy with the IRS. Likewise Coinbase Kraken Binanceus Gemini Uphold and other US exchanges do report to the IRS.

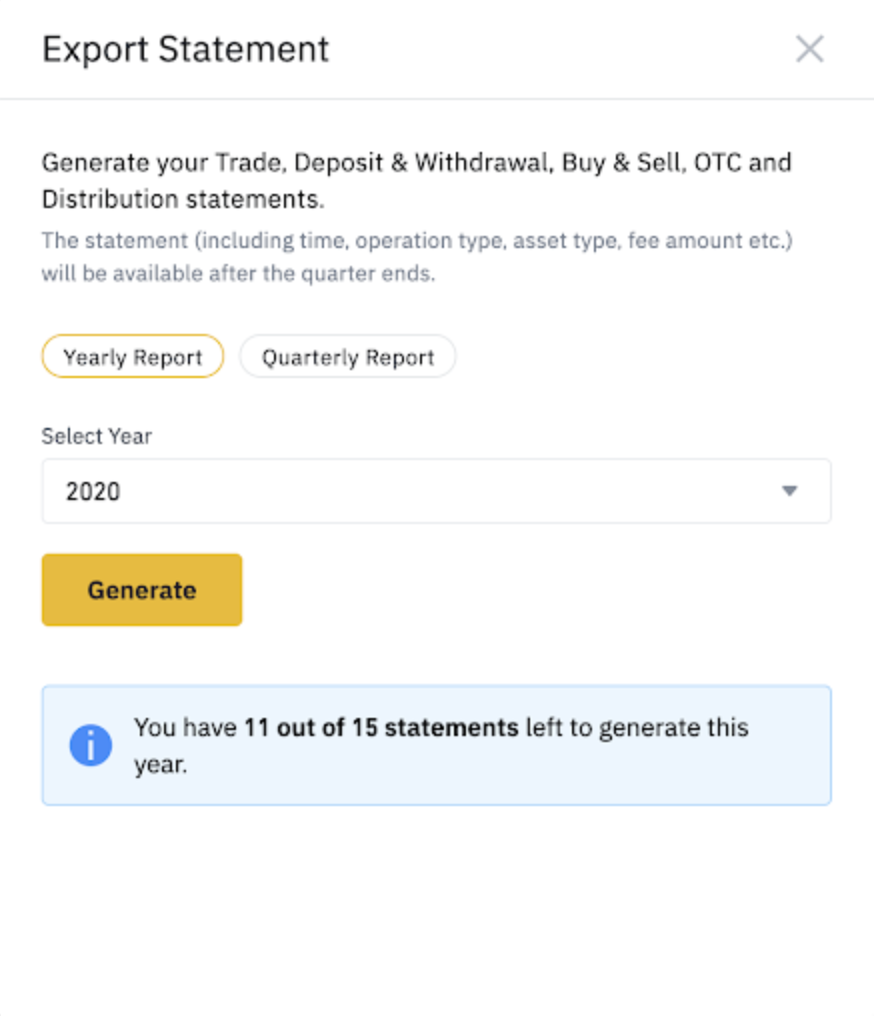

Although it previously issued certain traders Forms 1099-K BinanceUS discontinued the practice in favor of the Form 1099-MISC for the 2021 tax year. Binance US offers detailed breakdowns of customers transactions based on historic trades as well as special forms that are prepared directly for the Internal Revenue Service IRS but more. When you receive a 1099-K form from a crypto exchange the IRS gets a copy too.

Binance US reports to the IRS. Binance previously issued a 1099-K form to users with more than 200 transactions totaling more than 20000 in value throughout a single financial year. The best crypto tax software to import and track your Binance trades is CoinTracking.

Answer 1 of 12. If you receive a Form 1099-B and do not report it the same principles apply. The best Binance taxes calculator.

BinanceUS is no more a part of the Blockchain Association. Binance US shares customer data with the IRS every time they issue a 1099-MISC form to a user as the IRS gets an identical copy. Does Binance Report to HMRC.

Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards. Instead it maintains a separate website for American traders called BinanceUS. According to their website they stopped issuing 1099-K s from 2021 so they dont report to the IRS.

Therefore if you receive any tax form from an exchange the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties. Does Binance US report to the IRS. Because it no longer serves traders in the United States Binance does not have to report to the IRS.

The IRS states that US taxpayers are required to report gains and losses or income earned from crypto rewards based on certain thresholds on their annual tax return Form 1040. It is a one stop shop for cryptocurrency trading buying and. Previously BinanceUS took the position that it was a Third Party Settlement Organization TPSO under Section 6050W of the Internal Revenue Code and accordingly filed Forms 1099-K for certain transactions settled on the exchange.

NO Binance does not report to the IRS. Does Binance report to tax authorities. As well as this many larger crypto exchanges are being pressured by the IRS to share more customer data to ensure tax compliance.

Does BinanceUS report to the IRS. Binance based in Malta is one of the most well-known cryptocurrency exchanges in the world. According to their website.

They can request your data from any larger crypto exchange operating in the US. As well as this some wallets ask for data like your phone number or bank account. However Binance US may comply with the US tax law and provide tax reports to the IRS.

Does Binance US report to the IRS. BinanceUS makes it easy to review your transaction history. It performs over 1400000 transactions per second.

Answer 1 of 5. The best way. Binance US reports to the IRS.

Binance a Malta-based company is one of the most popular crypto exchanges in the world.

How To Report Your Binance Us Taxes Binance Us Tax Forms

Does Binance Us Report To The Irs Quora

Binance Us Cryptotrader Tax Demo Automating Your Crypto Tax Reporting Youtube

How To Do Your Binance Us Taxes Koinly

Does Binance Us Report To The Irs

Binance Us Tax Statements Portal Binance Us Blog

Binance Us Tax Statements Portal Binance Us Blog

Does Binance Us Report To The Irs

Binance Will Lock United States User S Accounts In 14 Days Coingeek

Does Binance Us Report To The Irs

Don T Get Banned By Binance How To Switch From Binance To Binance Us Cointracker

Does Binance Us Report To The Irs

How To Export Your Binance Us Transaction History Binance Us

Binance Us Launches Tax Statements Portal And Joins Taxbit Network Taxbit Blog

News Binance Exchange To Get Investigated By The U S Authorities In 2021 Investigations Internal Revenue Service Author

Binance Us Launches Tax Statements Portal And Joins Taxbit Network Taxbit Blog

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Richard Nuse Sr Manager Tax Information Reporting Binance Us Linkedin